Divergence occurs when the direction that an asset's prices and that of technical indicators change in opposing directions. Divergence in momentum, price indicators such as the RSI/MACD could be helpful in identifying potential changes to an asset’s price. This is why it is a cornerstone for numerous trading strategies. We are happy to announce that divergence is now accessible to help you design open and closed conditions for trading strategies with cleo.finance. See the top rated for blog tips including be in forex, auto trading bot, galileo fx automated trading reddit, saxo bank minimum deposit, free forex trading signals daily, ai automated trading, daily forex signals, pro rsi divergence indicator mt4, binance auto trader bot, degiro automated trading, and more.

There Are Four Main Kinds Of Divergences:

Bullish Divergence

The technical indicator shows higher lows and price has lower lows. This suggests a weakening of the downtrend's momentum and a possible reversal upside.

Hidden Bullish Divergence

The oscillator makes lower lows but the price makes higher lows. Hidden bullish divergence signals that the uptrend will continue. It could be found near the bottom of a price throwback (retracement downward).

Hidden Bullish Divergence explanation

Quick Notes

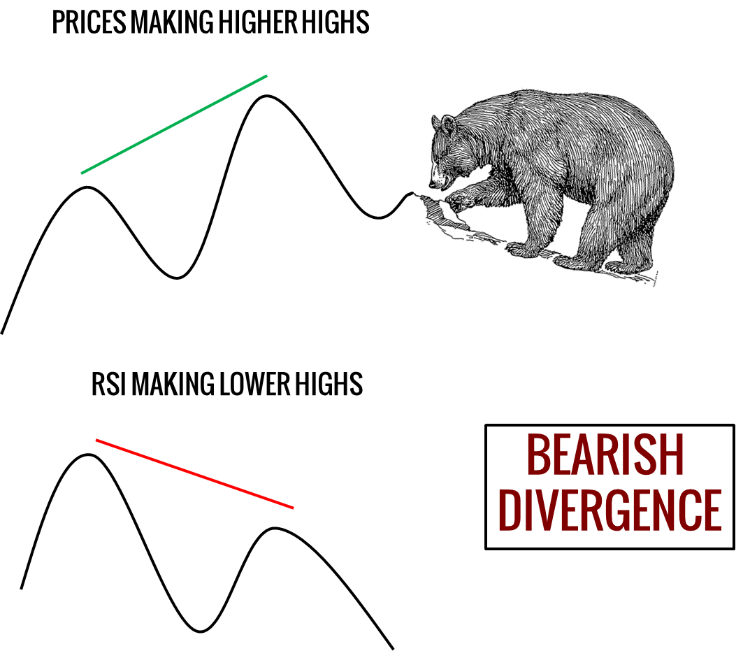

Bearish Divergence

As price is making higher highs and the indicators that show lower highs, this indicates that the price is creating higher highs. This indicates that the momentum to the upside has slowed down and is expected to reverse towards the downwards.

Bearish Divergence Explanation

Quick Notes: If the indicator is in an uptrend and the peak is visible then it will be moving down first

Hidden Bearish Divergence

The oscillator makes higher highs while the price makes lower highs. An unnoticed bearish divergence could signalize that downtrend will continue and can be found near the bottom of a pullback in price (retracement upwards).

Hidden Bearish Divergence Explanation

Quick Notes: Price moves down when price peaks in a downtrend drawback

Regular divergences provide a reversal signal

Regular divergences can be powerful signals that a trend reversal could be imminent. They signal that the trend has weakened but is still strong and give a early sign of possible direction changes. Divergences that are regular can be potent entry triggers. Check out the recommended for more examples including trading fees binance, day trade crypto reddit, algo trading programs, forex hours, voyager crypto exchange, thinkorswim automated trading drag and drop, best leverage for small account, trading automatic, ftmo account, fbs no deposit bonus 2021, and more.

Hidden Divergences Signal Trend Continuation

Hidden divergences, on other hand , are indicators of continuation, which can be found at the middle or the top of a trend. Hidden divergences can signal that the current trend will likely to continue following a pullback. These signals could also be powerful entry triggers when there is confluence. The traders often make use of hidden divergences to join an established trend after the pullback.

Validity Of The Divergence

A momentum indicator such as RSI or Awesome oscillator is the most effective method to gauge the divergence. These indicators are focused on the current trend and, therefore, trying to calculate divergence from 100+ candles back does not provide any value in terms of predictive power. However altering the indicator's duration alters the look-back time range for a valid divergence. Make sure to use discretion when determining if the divergence is legitimate. Any divergences could not be valid.

Available Divergences in cleo.finance:

Bullish Divergence

Bearish Divergence

Hidden Bullish Divergence:- Follow the recommended for blog advice including robot trading on binance, best forex trading strategy, okex auto trader, wintermute crypto, xm forex broker, crypto margin, 3commas exchange, top rated crypto exchanges, robo trade program, nasdaq on exness, and you can compare those divergences between two points:

Price With An Oscillator Indicator

An oscillator and a second indicator Price of any assets along with the cost of any other asset

Here's how to use the differentiators on cleo.financebuilder

Opening up conditions by using Hidden Bullish Divergence in cleo.finance

Customizable Parameters

There are four choices which can be modified to tailor divergences.

Lookback Range (Period)

This parameter sets how far back should the strategy look for the divergence. The default value of 60 is "Look for divergence in any of the 60 bars."

Min. Distance Between Peaks/Troughs (Pivot Lookback Left)

This parameter specifies the number of candles need to be lit on the left side to confirm the location of the pivot point.

Confirmation bars (Pivot Lookback Right)

This parameter defines the number of bars on the right side must be present to confirm that the pivot point is discovered. Read the top rated for site advice including online auto trading, direct forex signals, pro real time automated trading, ascendex crypto, automated penny stock trading software, bittrex trading fees, best forex indicator, ally forex, forex trading company, alpari metatrader 4, and more.

Timeframe

You may define here the timeframe within the period that the divergence needs to be observed. This timeframe can be different from the execution timeframe of the strategy.Customizable parameter settings of divergences on cleo.finance

Divergences parameter settings on cleo.finance

The pivot point settings determine the peak/trough of each divergence. Maintain the default settings of an inverse bullish Divergence

Lookback Range (bars: 60)

Min. Distance between troughs, (left) = 1

Confirmation bars Right = 3

This implies that the divergence troughs must be located within 5 bars of one another (less than 1 bar to the left or 3 bars to the left). This applies to both the troughs that are found within the 60 candle lookback interval. After three bars, when the closest pivot point is discovered, the divergence will be confirmed.

Available Divergencies In Cleo.Finance

Most commonly, RSI or MACD divergence is used. However, you can test any other oscillator and trade it live using the trading automation platform cleo.finance. Check out the best for website advice including best crypto brokers, largest crypto exchanges, 3commas app, tradingview strategy automation, brokers with nas100, apps for buying cryptocurrency, automated technical analysis, voyager trading fees, foreign currency market, renko automated trading, and more.

In Summary

Divergences can be an important instrument for traders to add to their arsenal. However, they should be used in a cautious and deliberate manner. Keeping these points in mind allows traders to utilize diveRSIons to aid in making better trade decisions. It is essential to look at divergences strategically and with a clear head. Combining them with other technical and fundamental analyses, such as Fib retracements or Support and Resistance lines, only increases the credibility of the credibility of the divergence. Our Risk Management guides provide information about stop loss placement and positioning sizing. You can start making your best trading strategies for divergence right now with more than 55 indicators for technical analysis such as price action, price, and candlesticks data points! The cleo.finance website is constantly evolving. Please let us know when you are in need for an indicator data point, a data point or any other information.